Canadian Camping and RV Council - Recommendations to the Standing Committee on Finance Recommendation 1: That the Government amend the Income Tax Act to clearly define that income earned by private campgrounds who employ fewer than five full-time employees year-round be considered as “active business income” for the purpose of determining their eligibility for the small business deduction. (Click the post title above to read the full submission)

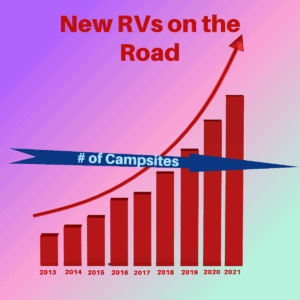

With the RV Industry’s growing popularity with young Millennials and retiring Baby Boomers, it has become increasingly apparent that record RV shipments combined with low campsite vacancy rates mean a te need to develop new destinations for consumers.

To remain viable, the RV Industry is asking to work with all levels of Government to reduce bureaucracy and help facilitate the development of new campgrounds and promote infrastructure improvements with existing campgrounds to add additional campsites for Canadian and Domestic consumers. Without more available camping destinations, we risk disenchanted consumers leaving our lifestyle altogether.

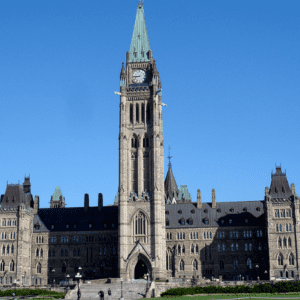

The RV and Camping Industry would be most interested in participating in the Parliamentary Outdoor Caucus along with other like-minded groups who conduct business in Canada. We would be grateful to be included in critical discussions that will have an impact on the future of the Canadian RV and Camping Industry.

Small Private Campgrounds throughout Canada continue to advocate the Federal Government to endorse change in the current Income Tax Act or enact other legislative measures that clearly distinguish small family run campgrounds with less than 5 full time employees as an “active business” and thus eligible for the small business tax deduction.

The classification of a Campground being assessed as a “Specified Investment Business” is ambiguous and up to arbitrary determination by the Canada Revenue Agency and the issue remains to be the #1 threat to not only Private Campgrounds, but to all RV and Camping Industry Stakeholders.

We are in support of programs such as the The Temporary Foreign Worker Program (TFWP) which allows Canadian employers to hire foreign nationals to fill temporary labour and skill shortages when qualified Canadian citizens or permanent residents are not available. We are encouraged measures announced in budget 2019 to accelerate and efficiently process Canadian visitor’s visas, work and student permits.

We would like to work with the Federal Government to develop additional programs to attract seasonal, part time employees to our remote area private campgrounds.